What are tokens?

Following our previous introductory article about DeFi and Yield Farming, lets first understand what are tokens.

Most readers probably know this, but just in case: Tokens are like the coins you earn when playing video-game, money you can use to buy gears in the universe of your favorite game.

But with blockchains, tokens can be earned in one place and used in lots of others. They usually represent either ownership in something or access to some service. We will talk about shortly on the relation of such tokens with a Decentralized Exchange called Uniswap where you can profit share by adding liquidity to a pool that will serve as a trading platform.

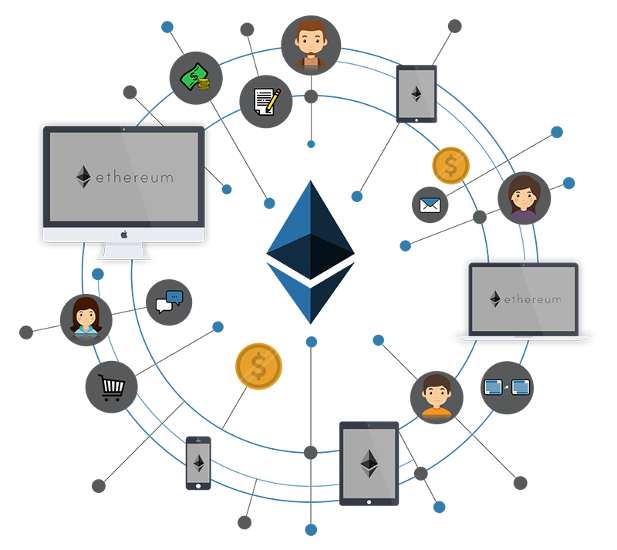

Tokens proved to be the big use case for Ethereum, the second-biggest blockchain in the world. The term of art here is “ERC-20 tokens,” which refers to a software standard that allows token creators to write rules for them.

Governance tokens, such as COMP or MKR are not like a token at a video-game arcade, as so many tokens were described in the past. They work more like certificates to serve in an ever-changing legislature in that they give holders the right to vote on changes to a protocol.

So on the platform that proved DeFi could fly, MakerDAO, holders of its governance token, MKR, vote almost every week on small changes to parameters that govern how much it costs to borrow and how much savers earn, and so on.

One thing all crypto tokens have in common, though, is they are tradable and they have a price. So, if tokens are worth money, then you can bank with them or at least do things that look very much like banking. Thus: decentralized finance.

Learn what is DEFI in the next article: https://blog.brozbot.com/2020/09/10/what-is-defi/