Are you paying attention on Altcoins or does your knowledge on cryptocurrency ends at Bitcoin?

When talking about cryptocurrency, the knowledge of most people ends at Bitcoin. After all, BTC is the main digital asset that receives regular mainstream media coverage.

If you’ve followed the crypto market over the past months, you’ve likely noticed the following: a majority of the best-performing altcoins are based on decentralized finance (DeFi).

But if you don’t have the time to follow it at all, then take a look at the bot many people are using to Automate your trading for Cryptos and Forex all in one place. Test it for free at https://brozbot.com.

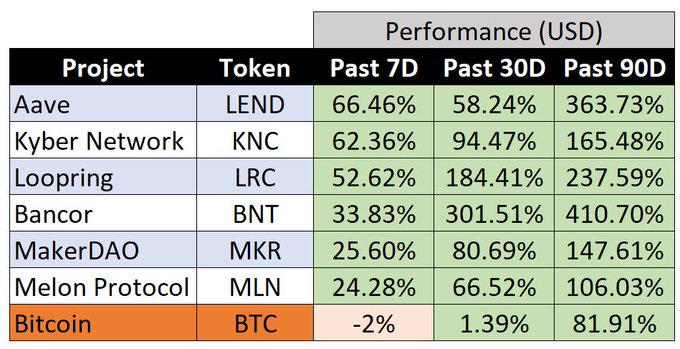

The image below from crypto analyst Taha Zafar depicts this trend well. While two weeks old, the table shows that as of the time of his analysis, DeFi coins were going parabolic.

Bitcoin had posted a 90-day gain of 81 percent while Aave, Kyber Network, Loopring, Bancor, Maker, and Melon have all posted gains in excess of 100 percent.

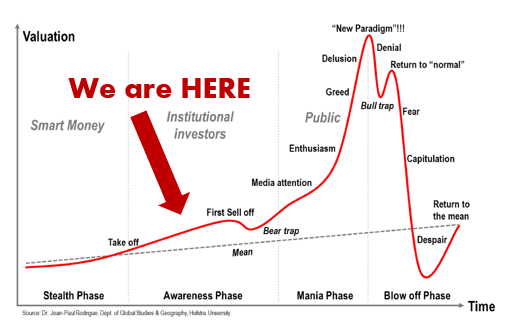

On Jul. 1, a crypto analyst released a 25-part thread on DeFi in which he shared his thoughts on “where we are in the state of the DeFi market from an ‘inside perspective.” The takeaway, as can be seen in the chart below, is that DeFi is still in the earliest phases of growth.

He attributed this optimistic sentiment to a number of trends:

Firstly, Kang explained that Defi usage has “traditionally been concentrated with hardcore users and/or ETH whales,” evidenced by the mere 1,000~2,000 addresses that actively used Ethereum finance applications just weeks ago.

What’s important about this statistic is that 1,000-2,000 users make up less than one percent of all active crypto users. That’s to say, DeFi has exponential growth potential. Heck, even one of Bitcoin’s biggest bulls, Chamath Palihapitiya, doesn’t know what DeFi is.

Secondly, Kang noted that Asian money — which is what drove many altcoin crazes during the 2017/2018 bubble — is starting to “feel the FOMO.”

And thirdly, DeFi development is “hitting an inflection point” with more on-chain liquidity, better development tools, successful case studies, education, and much more.

The confluence of these trends, according to the investor, indicates that DeFi has room to grow in the long run.

According to CryptoSlate data, DeFi tokens currently represent a $3.05 billion market or 1.17 percent of the entire cryptocurrency market cap.