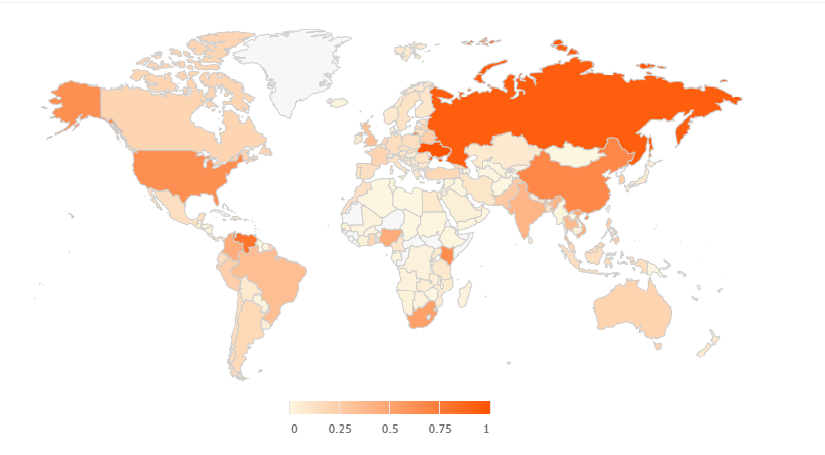

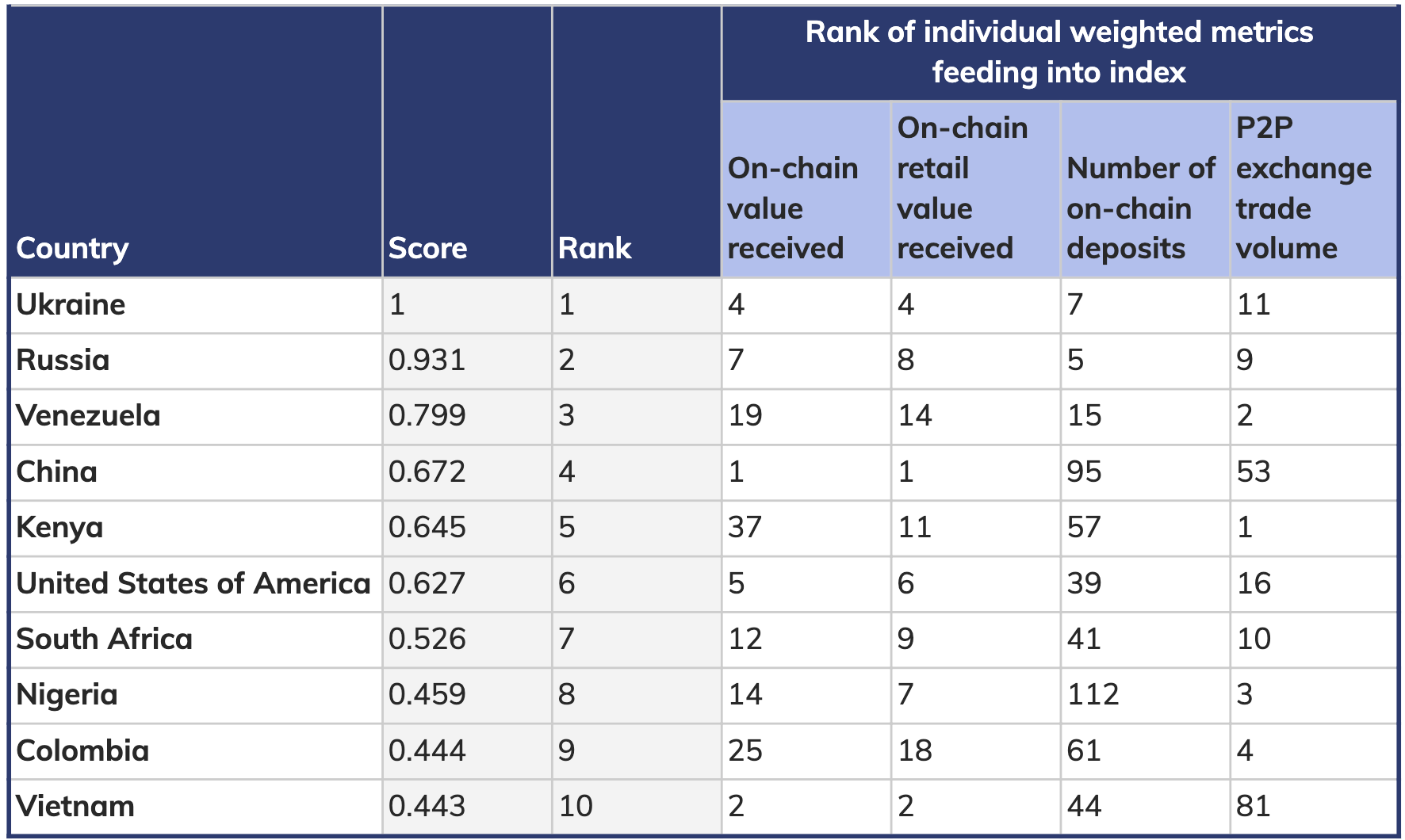

Top 10 countries in cryptocurrency usage

The list brings a new criteria to rank each country, taking into account indicators that represent real adoption in the domestic economy. Four metrics were used to rank 154 countries.

- Value of cryptocurrency received by chain, weighted by purchasing power parity (PPP) per capita. This indicator measures changes in the total amount of cryptocurrencies in the country, also taking into account the per capita wealth of individuals.

- Retail value transferred in the chain, weighted by PPP per capita. This metric measures the activity of non-professional users based on the average wealth of individuals in the country.

- Number of cryptocurrency deposits on the network, weighted by the number of Internet users. Measures the total number of transactions in blockchains considering the number of average internet users in the country.

- Peer-to-peer exchange trade volume (P2P), weighted by PPP per capita and number of Internet users. It is not possible to measure the transactions that took place from person to person, so this variable was measured based on the volume of decentralised platforms.

Values ranging from 0 to 1, with 1 being the highest score country in the ranking. It is worth mentioning the difficulty of obtaining this data due to the use of VPNs and other tools to mask a user’s geographic position, especially in countries with firewalls, such as China. However, the research shows a significant advance in measuring the actual adoption of cryptocurrencies in the world.

Let’s check the top 10.

Non-Developed Countries and Inflation

It is very interesting for enthusiasts to see that cryptocurrencies are being used more in places where they are needed the most. The non-developed countries at the top of the global adoption of cryptocurrencies have something in common: the high rates of inflation in the real economy. More and more people are turning to decentralized currency technology to protect their assets from the dreaded inflationary tax.

Many believe that Bitcoin was launched in 2009 in a certain hurry (or anxiety) from Satoshi Nakamoto because of the moment in which the world economy was in and, mainly, because of the solutions presented by central banks to solve the problem: of course, print more money.

The market trend is clear, adoption is increasing significantly worldwide. This adoption tends to happen in a snowball effect. The more people adopt them, the more fiat currencies (real, dollar and euro) depreciate and the more people see the need to protect their money from future devaluation.

Looking To Automate your Trading for Cryptos and Forex All In One Place?

If you don’t have the time to read charts and follow the news, then take a look at the bot many people are using to Automate your trading for Cryptos and Forex all in one place. Test it for free at https://brozbot.com.