For the first time since 2008 financial crisis the central bank has conducted an emergency rate cut.

The Federal Reserve cut benchmark interest rates on Tuesday March 3rd, by a half-point to the 1%-to-1.25% range, and market participants are now anticipating another half-point cut at the Fed’s scheduled March 18 meeting.

On Thursday, markets appeared to set the stage for another down session, as the Dow closed at 26,121.28, down 969.58 points, or 3.6%, while the S&P 500 US:SPX lost 106.18 points, 3.4%, to finish at 3,023.94. The Nasdaq Composite US:COMP fell 279.49 points, or 3.1%, to close at 8,738.60.

The big catalyst for markets this Friday may be any signs of the outbreak of the novel coronavirus impacting U.S. jobs. The U.S. likely added about 165,000 new jobs in February after a preliminary 225,000 gain in the first month of the year, according to economists surveyed by MarketWatch.

If there is a big deceleration in the pace of what had been heady gains in jobs, markets could indeed be in for another woeful Friday.

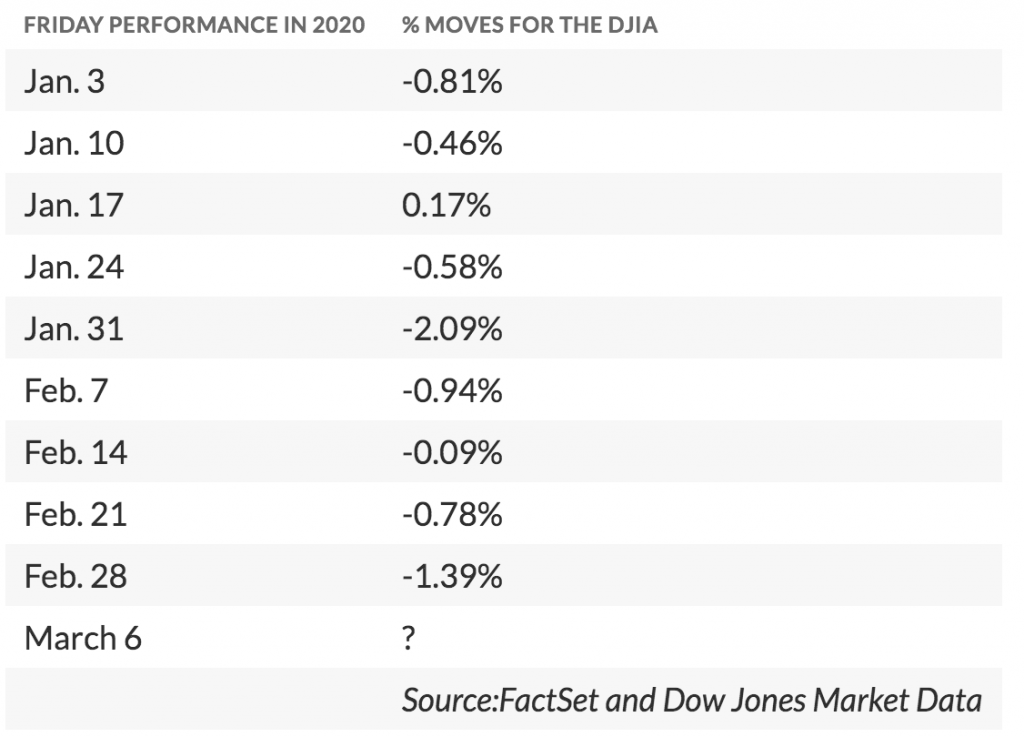

Even before the coronavirus anxiety reached its recent apex, the Dow has been trading tentatively on Fridays. So far this year, the blue-chip benchmark has been down eight of the past nine Fridays: